0818 Work Insights

Your go-to source for the latest work trends, tips, and advice.

Why Insurance Quotes Are Like Dating: Swipe Right for the Best Deal

Swipe right for the best insurance deals! Discover how finding quotes is just like dating—it's all about finding your perfect match.

Finding Your Perfect Match: How to Compare Insurance Quotes

Finding your perfect match in insurance doesn’t have to be a daunting task. When comparing insurance quotes, the first step is to outline your specific needs. Consider factors such as coverage limits, deductibles, and any additional features that may be important to you. Creating a checklist can help simplify this process:

- Identify your coverage needs

- Gather quotes from multiple insurers

- Compare premiums and out-of-pocket costs

Once you have gathered various quotes, it's essential to analyze them carefully. Look beyond just the price; read the policy details and understand what is included and excluded. Consider reaching out to insurance agents for clarification, as they can provide valuable insights. Don’t forget to review customer feedback and ratings, which can give you an idea of the insurer's reliability and service quality. By taking the time to thoroughly compare insurance quotes, you can find the policy that best fits your needs and budget, ensuring peace of mind and financial security.

The Dating Game: What to Look for in Insurance Quotes

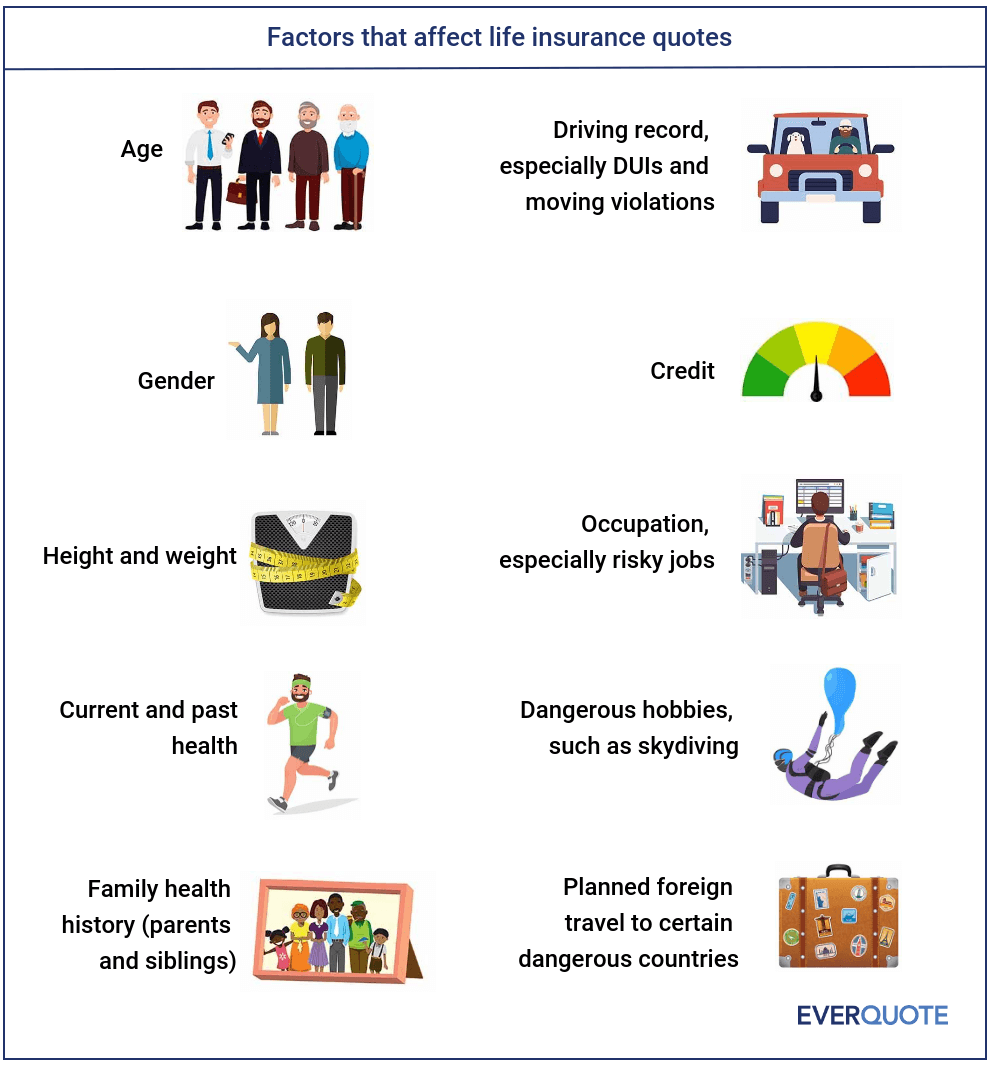

Choosing the right insurance can feel like a dating game, as you sift through various quotes to find the best fit for your needs. Start by evaluating the types of coverage offered; compare policies for essentials like liability, collision, and comprehensive coverage. Insurance quotes should also be assessed based on customer service ratings, as strong support can significantly enhance your overall experience. Remember to read the fine print to understand any exclusions or limitations that could affect your coverage.

Next, it's important to consider premium costs and how they align with your budget. Gather multiple quotes and don’t hesitate to ask about discounts; many companies provide reductions for safe driving, multiple policies, or even good credit. When you’re comparing quotes, create an ordered list of your priorities—this will help streamline your decision-making process. Ultimately, the goal is to find an insurer that offers a combination of affordability, comprehensive coverage, and excellent customer support, ensuring your peace of mind for the long haul.

Swipe Right on Savings: Tips for Choosing the Best Insurance Policy

Choosing the right insurance policy can feel like a daunting task, but with a few tips for choosing the best insurance policy, you can make the process simpler and more effective. Start by assessing your needs: Are you looking for health, auto, home, or life insurance? Each category comes with different coverage options, and understanding your specific requirements is crucial. Once you've identified your needs, compare quotes from multiple insurers. Don't just look at the premium; also evaluate the coverage limits and exclusions to ensure you're getting the best value for your money.

Another critical step is to read reviews and ratings of insurance companies from trusted sources. This can give you insight into their customer service and claims process. Additionally, consider speaking with an insurance broker who can provide personalized advice based on your unique situation. Remember, the cheapest policy isn't always the best one; instead, focus on a balance between cost and coverage. By keeping these tips for choosing the best insurance policy in mind, you can confidently swipe right on savings and secure the protection you need.