0818 Work Insights

Your go-to source for the latest work trends, tips, and advice.

Trade Bots: Your Secret Weapon in CS2 Market Battles

Unlock the power of trade bots and dominate the CS2 market! Discover strategies to boost your game and profits now!

How Trade Bots Can Maximize Your Profits in CS2 Market Transactions

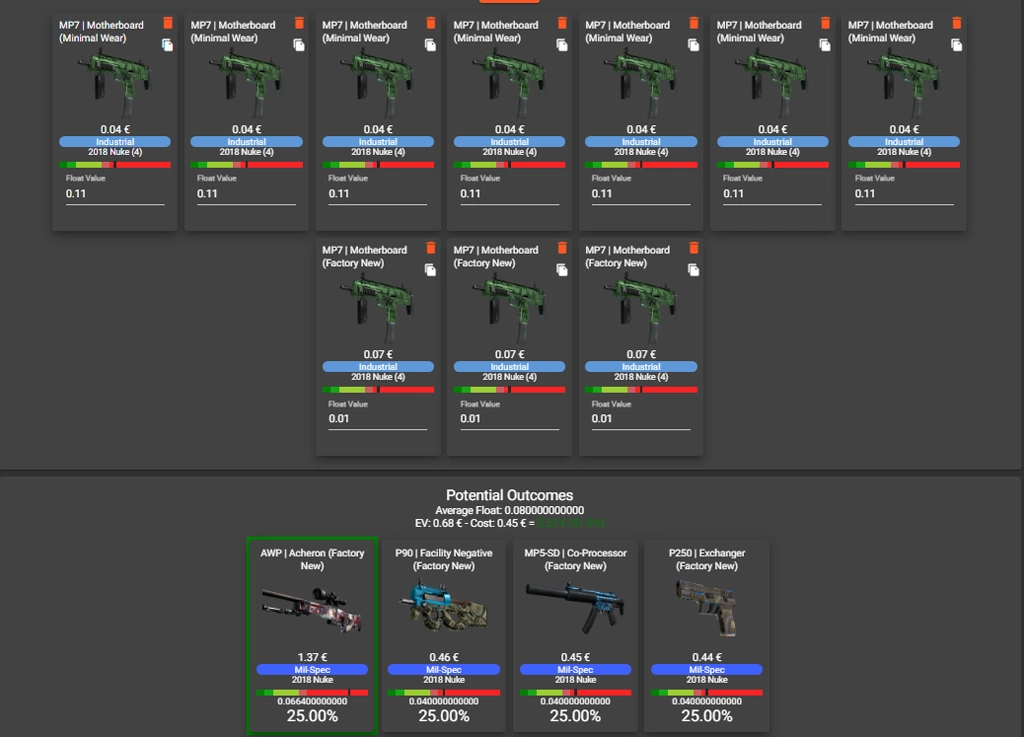

In the competitive landscape of the CS2 market, leveraging trade bots can significantly enhance your profit margins. These automated systems analyze vast amounts of data and market trends, enabling you to make informed decisions at lightning speed. By implementing a trade bot, you can execute high-frequency trades that human players may miss due to reaction time. Additionally, these bots are programmed to identify and exploit arbitrage opportunities, which can lead to enhanced returns during fluctuating market conditions.

Moreover, utilizing trade bots in your CS2 market transactions can save you considerable time and reduce the likelihood of emotional trading. Unlike manual traders who may react impulsively to market changes, bots operate on predefined algorithms that ensure your trading strategy is executed flawlessly. This systematic approach not only maximizes your chances of profit but also allows for better risk management. Incorporating a trade bot into your trading arsenal could be the key to unlocking new levels of success in your CS2 investments.

Counter-Strike is a highly popular first-person shooter game that emphasizes teamwork and strategy. Players engage in intense matches where they can change crosshair settings to improve their aiming precision. With various game modes and a vibrant competitive scene, it has become a staple in the esports community.

The Ultimate Guide to Setting Up Your CS2 Trade Bot

Setting up your CS2 trade bot can significantly enhance your trading experience, allowing you to trade more efficiently and automate mundane tasks. First, you'll need to choose the right platform to create and host your bot. Popular options include Node.js, Python, and Java. Once you've selected your programming language, familiarize yourself with the Steam API, as it provides essential access to user inventories and trading functions. Additionally, consider utilizing libraries like SteamCommunity for Node.js or Steam.py for Python, which can simplify many interactions with the Steam platform.

After setting up the technical foundation, it's crucial to determine the trading strategy your bot will follow. Here are a few strategies you might consider implementing:

- Market Making: Your bot would provide liquidity by continuously buying and selling items at specified prices.

- Arbitrage: Take advantage of price differences on different markets or platforms to make a profit.

- Sniping: Monitor listings for below-market prices and execute trades quickly.

By carefully planning your bot's operations and strategies, you can maximize its efficiency and profit potential, making your CS2 trade bot an invaluable tool in your trading arsenal.

Are Trade Bots the Future of CS2 Marketplace Strategy?

As the competitive landscape of the CS2 marketplace evolves, many players are turning to advanced technologies to enhance their trading strategies. One of the most promising innovations in this space is the use of trade bots. These automated systems can analyze vast amounts of market data in real-time, making informed decisions that human traders might overlook. By leveraging algorithms, trade bots can execute trades at lightning speed, eliminate emotional biases, and optimize capital allocation. This has led many experts to question whether trade bots could be the key to unlocking future profits in the CS2 marketplace.

However, the adoption of trade bots is not without its challenges. Issues such as market volatility, the potential for algorithmic errors, and ethical considerations regarding automation must be taken into account. Additionally, the CS2 marketplace is constantly evolving, which means that trade strategies must be regularly updated. Some traders fear that reliance on trade bots might increase market manipulation or lead to a less personal trading experience. Nevertheless, as technology continues to advance, the potential for trade bots to transform the CS2 marketplace strategy remains significant, and early adopters may find themselves well ahead of the competition.